There are many ways to support our work.

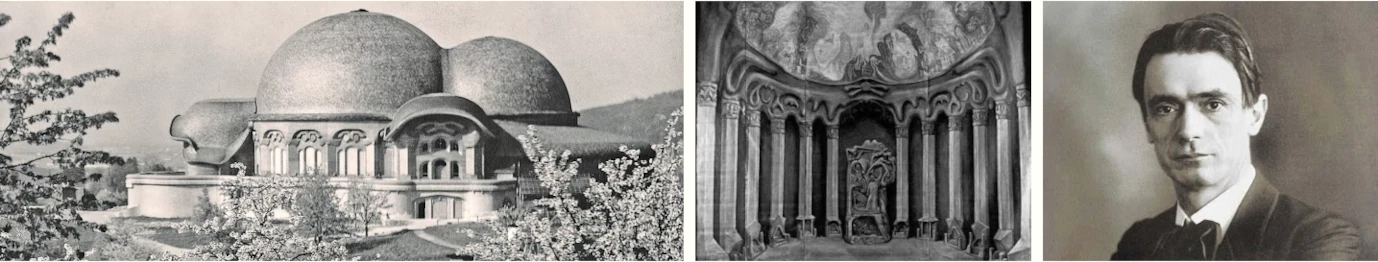

The Rudolf Steiner Archive is funded by tax-deductible donations to the nonprofit Steiner Online Library. Your gifts help us to make Dr. Steiner's teachings available online in English in a searchable, digital format. Nearly 100 years since his death, much of his work is not yet available online in English. We aim to rectify this. With your financial support we can continue to make this material more accessible, publishing our own English translations of works currently only available in German.

- Donate Online

- Donate by Mail

- Donate & Buy Books

- Sell anything on eBay

- Donate Your Required IRA Distribution

- Contribute Goods or Services

- Give Through a Will or Estate Plan

- Memorials and Tribute Gifts

Your gifts to Steiner Online Library, the nonprofit supporting the Rudolf Steiner Archive, are tax-deductible to the fullest extent of the law.

US Federal Tax ID 85-2621701

Donate Online

Credit/debit card or PayPal.

Other (non-PayPal) Option

Recurring Payments

Schedule monthly or annual donations through your bank payment system or through PayPal.

Avoid Domestic and International Transaction Fees & Anonymous Donation Option:

Give through PayPal's Donor Advised Fund. No transaction fees are deducted from your donation so we receive 100% of your gift.

Donate by Mail

Mail a check made out to Steiner Online Library to the following address. To make a recurring monthly donation through your bank, simply add us as a Payee in your bank payment system.

Mailing Address:

Steiner Online Library

PO Box 42

Interlochen, MI 49643 USA

Donate Books

Donate your extra anthroposophical books and we will find them a good home. We will post what we can online, retain our best copy and sell duplicates through our online used bookstore. You get a donation receipt for tax purposes and help us fund the Rudolf Steiner Archive. Consider donating books now or add them to your will and estate plan as indicated below. Learn More →

Buy Books

Shop the Rudolf Steiner Archive Bookshop for anthroposophical, esoteric, and other books donated to Steiner Online Library. Proceeds fund our work on the Rudolf Steiner Archive. Your purchases will help us develop the website further, add new content, generate new translations, and share this work to researchers around the world. Plus, you will help ensure these important books don't end up in a landfill somewhere when people pass on.

Sell anything on eBay

List items for sale on eBay and designate the proceeds to go to the nonprofit of the Rudolf Steiner Archive. It's a great way to support our work!

Donate Your Required IRA Distribution

If you are 70 ½ or older and own an IRA, you may make a direct transfer of all or part of your annual required minimum distribution (RMD) obligation to benefit the Rudolf Steiner Archive without including the withdrawal in your adjusted gross income. A qualified charitable distribution (QCD) from your IRA to Steiner Online Library is a tax-efficient way of making a donation.

In-kind Donations

We welcome non-monetary donations of goods and services from individuals, companies, and other nonprofits.

- Bookeye book scanner (new or used) to digitize texts while ensuring the spine is not damaged

- Property to house our expanding library, office, and staff (or other real estate). Eliminate capital gains tax due from a sale of property by donating a personal residence, vacation home, timeshare property, farm, commercial property, or undeveloped land.

- Securities or mutual funds. Reduce or even eliminate federal capital gains taxes on the transfer and receive a federal income tax charitable deduction based on the fair market value of the gift at the time of the transfer.

- and of course... anthroposophical books (new or used).

Give Through a Will or Estate Plan

Contact us for additional information on bequests or to discuss different options for including Steiner Online Library in your will or estate plan. Seek the advice of your financial or legal advisor. Here is the information you will need for your gift:

Steiner Online Library is a 501(c)(3) tax exempt non-profit Michigan corporation with a mailing address of PO Box 42, Interlochen, MI 49643. Its Federal Tax ID is 85-2621701

Wills and Living Trusts

In as little as one sentence you can complete your gift to the Steiner Online Library and ensure your lasting legacy.

I give, devise, and bequeath to Steiner Online Library, a Michigan nonprofit corporation with Federal Tax ID Number 85-2621701 (a) the sum of $___________ in cash or in-kind or (b) ______% of my estate or (c) property described herein as ______________ to be used for the benefit of Steiner Online Library as the institution may determine.

Personal Property

Donate Steiner-related materials (books, journals, etc.) and other tangible personal property to ensure your collection is put to good use.

Retirement Plan Assets

Money in an employee retirement plan, IRA or tax-sheltered annuity has yet to be taxed. While your loved ones would owe federal income tax as a beneficiary, Steiner Online Library is a tax-exempt nonprofit and will receive the full amount of what you designate to us from your plan.

Beneficiary Designations

Name Steiner Online Library as the beneficiary of the entire account or a percentage of the account.

- Bank or Brokerage accounts

- IRAs and retirement plans

- Life insurance policies

- Commercial annuities

- Donor Advised Funds

Insurance

A gift of life insurance is one of the most efficient ways to make a major gift to Steiner Online Library. The simplest way to donate insurance is to designate the SOL as a beneficiary of your life insurance policy. You can also arrange to donate a whole life insurance policy to SOL. By donating your policy, you will yield a current income tax donation and reduce your overall taxable estate.

Securities

When you give appreciated securities or mutual funds you can reduce or even eliminate federal capital gains taxes on the transfer. You may also be entitled to a federal income tax charitable deduction based on the fair market value of the securities at the time of the transfer.

Real Estate

Want to make a big gift to Steiner Online Library without touching your bank account? Eliminate capital gains tax due from a sale by donating real estate such as a personal residence, vacation home, timeshare property, farm, commercial property, or undeveloped land.

Facility Needed: We are also seeking a building to house our expanding inventory, library and its caretakers. If you have suggestions of available spaces or would like to help us acquire a property, please contact us.

Donor Advised Funds

Like a charitable savings account, a DAF gives you the flexibility to recommend how much and how often money is granted to Steiner Online Library and other qualified charities.

Memorials and Tribute Gifts

Make a gift to Steiner Online Library in a friend or relative's name. Not only will your dear one's legacy live on thanks to the gift, but the donor also receives a federal income tax charitable deduction on itemized taxes.